Faraid-Inheritance Calculator app for iPhone and iPad

Developer: Emrah Demirci

First release : 26 Jul 2021

App size: 63.96 Mb

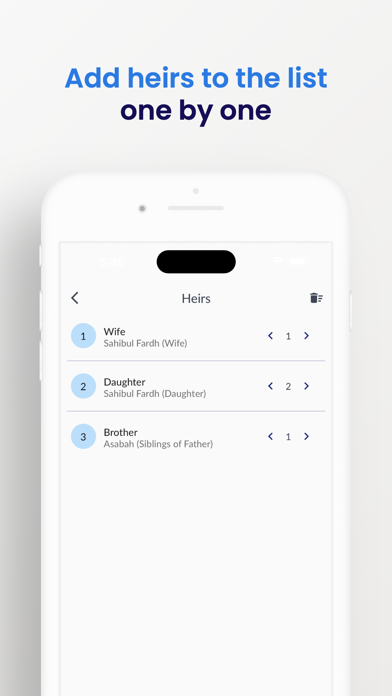

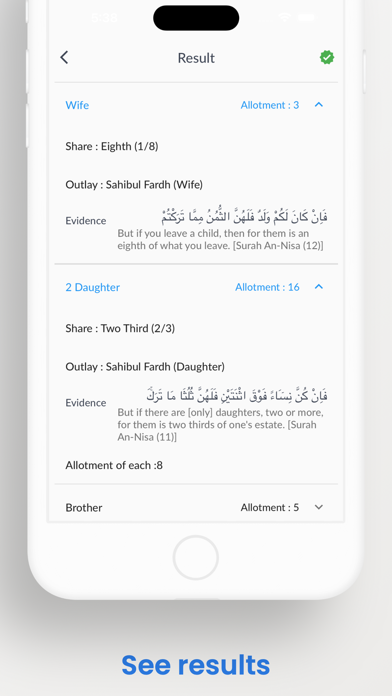

To calculate the inheritance; enter the information about the relatives of the deceased. After all the relevant information has been entered, click on the calculate button to know about how much each relative will inherit as per Islamic inheritance calculation according to Islam.

About Inheritance in Islam and Quran:

Distribution of inheritance (Meeras / Wirasat) carries a special place in Islam and is a very important component of the Muslim faith and is considered as an integral part of the Sharia Law. Among the relatives in Islam, there is a legal share as per Quran for each descendant in monetary value/property the deceased has left. Quran has mentioned different shares over the matters of Islamic inheritance.

Details of inheritance in Islamic law

Inheritance is considered as an integral part of Shariah Law. Muslims inherit from one another as stated in the Quran.[Quran 4:7] Hence, there is a legal share for relatives of the decedent in his estate and property. The major rules of inheritance are detailed in Quran, Hadith and Fiqh.

When a Muslim dies there are four duties which need to be performed. They are:

Pay funeral and burial expenses.

Paying debts of the deceased.

Determine the value / will of the deceased if any (which is capped to one third of the estate as the remainder is decided by shariah law).

Distribute the remainder of estate and property to the relatives of the deceased according to Shariah Law.

Therefore, it is necessary to determine the relatives of the deceased who are entitled to inherit, and their shares.

These laws take greater prominence in Islam because of the restriction placed on the testator (a person who makes a will). Islamic law places two restrictions on the testator:

To whom he or she can bequeath his or her wealth.

The amount that he or she can bequeath (which must not exceed one third of the deceaseds estate).

Different types of heirs

Heirs referred to as primary heirs are always entitled to a share of the inheritance, they are never totally excluded. These primary heirs consist of the spouse relict, both parents, the son and the daughter. All remaining heirs can be totally excluded by the presence of other heirs. But under certain circumstances, other heirs can also inherit as residuaries, namely the father, paternal grandfather, daughter, agnatic granddaughter, full sister, consanguine sister and mother. Those who inherit are usually categorized into three groups:

Quota-heirs (Sahibul Fardh), This group includes four males and eight females. The male quota-heirs are the husband, father, paternal grandfather and maternal brother. The females quot-heirs are the wife, daughter, granddaughter, mother, grandmother, full sister, paternal sister and maternal sister. However, there are scenarios that could move the daughter, granddaughter, father, grandfather, full siblings and paternal siblings to the second group (Asabah).

Members of the Asabah (residuaries), usually a combination of male (and sometimes female) relatives that inherit as residuaries after the shares of the Quota-heirs is distributed.

Extended family members (Zawul Arham): This includes any blood relative who is not a quot-heir or asabah (residuary). Examples include maternal grandfather, aunts, nieces and female cousins. This app can not calculate this category. But we are working on it